Property Tax Calculator Brevard County Florida . florida property taxes are relatively unique because: Brevard county is rank 43rd out of. Adjust to suit your needs. To estimate the property tax bill for a property, start by searching for the property and selecting it. in our calculator, we take your home value and multiply that by your county's effective property tax rate. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This is equal to the median property tax paid. real property tax estimator. brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. Taxes on each parcel of real property have to be.

from printablemapaz.com

in our calculator, we take your home value and multiply that by your county's effective property tax rate. brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). To estimate the property tax bill for a property, start by searching for the property and selecting it. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Adjust to suit your needs. Taxes on each parcel of real property have to be. real property tax estimator. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. florida property taxes are relatively unique because: This is equal to the median property tax paid.

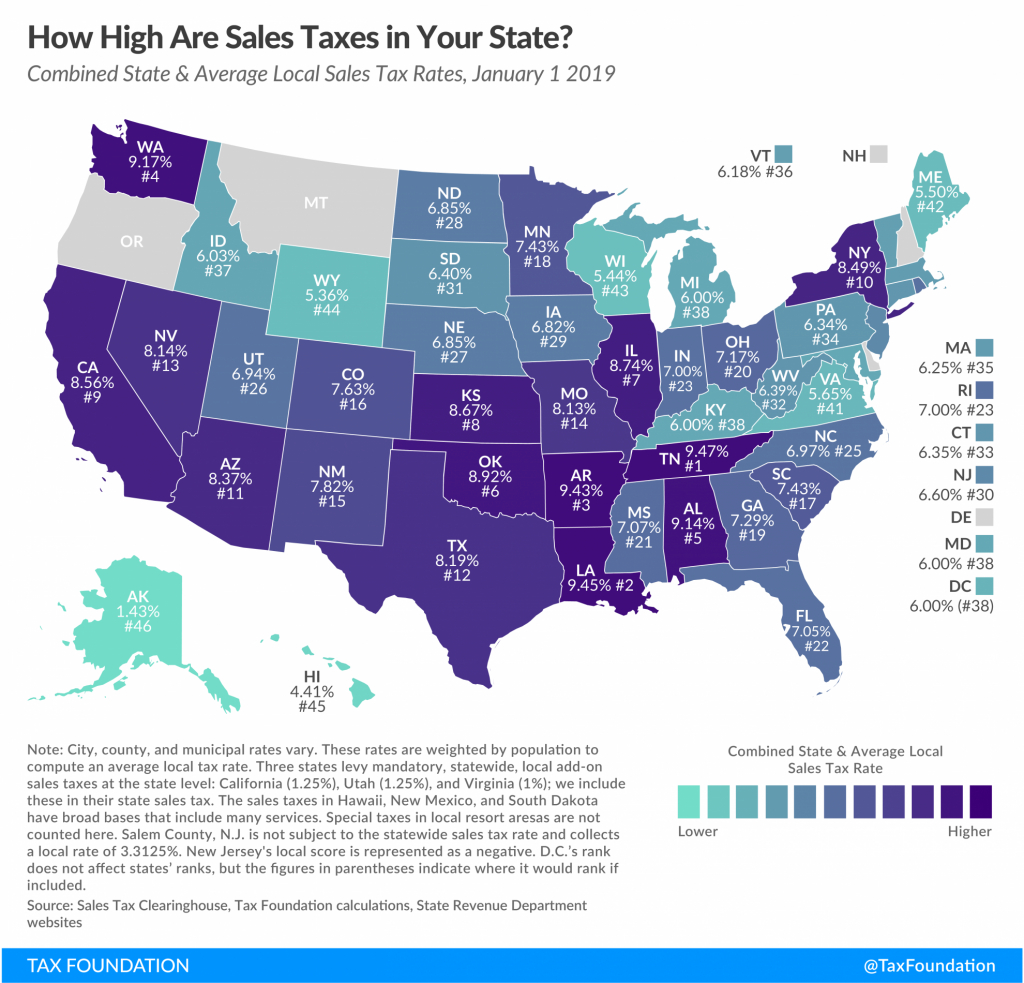

State And Local Sales Tax Rates, 2019 Tax Foundation Florida

Property Tax Calculator Brevard County Florida brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. This is equal to the median property tax paid. Taxes on each parcel of real property have to be. Brevard county is rank 43rd out of. Adjust to suit your needs. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). florida property taxes are relatively unique because: To estimate the property tax bill for a property, start by searching for the property and selecting it. in our calculator, we take your home value and multiply that by your county's effective property tax rate. real property tax estimator.

From ill-always-believe.blogspot.com

Brevard County Property Appraiser Online Real Estate Property Tax Calculator Brevard County Florida in our calculator, we take your home value and multiply that by your county's effective property tax rate. To estimate the property tax bill for a property, start by searching for the property and selecting it. real property tax estimator. florida property taxes are relatively unique because: our brevard county property tax calculator can estimate your. Property Tax Calculator Brevard County Florida.

From www.brevardtaxcollector.com

Brevard County Tax Collector Lisa Cullen, CFC Property Tax Calculator Brevard County Florida brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). This is equal to the median property tax paid. Adjust to suit your needs. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. florida property taxes are relatively. Property Tax Calculator Brevard County Florida.

From dxotwobwg.blob.core.windows.net

House Rentals In Brevard County Fl at Clay blog Property Tax Calculator Brevard County Florida our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. To estimate the property tax bill for a property, start by searching for the property and selecting it. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you. Property Tax Calculator Brevard County Florida.

From ill-always-believe.blogspot.com

Brevard County Property Appraiser Online Real Estate Property Tax Calculator Brevard County Florida Adjust to suit your needs. real property tax estimator. This is equal to the median property tax paid. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. To estimate the property tax bill for a property, start by searching for the property and selecting it.. Property Tax Calculator Brevard County Florida.

From humeranikki.blogspot.com

26+ Florida Property Tax Calculator HumeraNikki Property Tax Calculator Brevard County Florida our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. in our calculator, we take your home value and multiply that by your county's effective property tax rate. brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). Taxes on each. Property Tax Calculator Brevard County Florida.

From rentinbrevard.com

Important Things Brevard County Landlords Need to Know About Taxes Property Tax Calculator Brevard County Florida our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. florida property taxes are relatively unique because: brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). Brevard county is rank 43rd out of. real property tax estimator.. Property Tax Calculator Brevard County Florida.

From www.pdffiller.com

Fillable Online Brevard County Property Tax Homestead Exemption Property Tax Calculator Brevard County Florida brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). in our calculator, we take your home value and multiply that by your county's effective property tax rate. To estimate the property tax bill for a property, start by searching for the property and selecting it. This is equal to the median. Property Tax Calculator Brevard County Florida.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Calculator Brevard County Florida Taxes on each parcel of real property have to be. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. To estimate the property tax bill. Property Tax Calculator Brevard County Florida.

From exohiwrsf.blob.core.windows.net

How Much Are Property Taxes In Brevard County Florida at Dustin Black blog Property Tax Calculator Brevard County Florida Taxes on each parcel of real property have to be. florida property taxes are relatively unique because: brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). This is equal to the median property tax paid. real property tax estimator. Brevard county is rank 43rd out of. To estimate the property. Property Tax Calculator Brevard County Florida.

From www.youtube.com

Locate Brevard County Tax Deed Surplus Records Florida Overbids YouTube Property Tax Calculator Brevard County Florida Adjust to suit your needs. To estimate the property tax bill for a property, start by searching for the property and selecting it. Brevard county is rank 43rd out of. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. This is equal to the median property. Property Tax Calculator Brevard County Florida.

From www.floridaforboomers.com

10 Highest (and Lowest) Florida County Property Taxes Florida for Boomers Property Tax Calculator Brevard County Florida in our calculator, we take your home value and multiply that by your county's effective property tax rate. real property tax estimator. Adjust to suit your needs. This is equal to the median property tax paid. Taxes on each parcel of real property have to be. our team is prepared to assist you with any questions you. Property Tax Calculator Brevard County Florida.

From exohiwrsf.blob.core.windows.net

How Much Are Property Taxes In Brevard County Florida at Dustin Black blog Property Tax Calculator Brevard County Florida real property tax estimator. in our calculator, we take your home value and multiply that by your county's effective property tax rate. Taxes on each parcel of real property have to be. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. florida property taxes are. Property Tax Calculator Brevard County Florida.

From issuu.com

PROPERTY TAX CALCULATOR by Cutmytaxes Issuu Property Tax Calculator Brevard County Florida Brevard county is rank 43rd out of. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. real property tax estimator. Taxes on each parcel of real property have to be. Adjust to suit your needs. in our calculator, we take your home value and multiply that. Property Tax Calculator Brevard County Florida.

From kayleycaroline.blogspot.com

32+ florida mortgage tax calculator KayleyCaroline Property Tax Calculator Brevard County Florida florida property taxes are relatively unique because: brevard county (0.72%) has a 12.2% lower property tax rate than the average of florida (0.82%). Adjust to suit your needs. To estimate the property tax bill for a property, start by searching for the property and selecting it. our brevard county property tax calculator can estimate your property taxes. Property Tax Calculator Brevard County Florida.

From www.youtube.com

Brevard County FL Real Estate CMA Property Appraisal US Home Value Property Tax Calculator Brevard County Florida real property tax estimator. Brevard county is rank 43rd out of. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. Taxes on each parcel of real property have to be. Adjust to suit your needs. our brevard county property tax calculator can estimate your. Property Tax Calculator Brevard County Florida.

From www.stlouis-mo.gov

How to Calculate Property Taxes Property Tax Calculator Brevard County Florida Brevard county is rank 43rd out of. in our calculator, we take your home value and multiply that by your county's effective property tax rate. real property tax estimator. florida property taxes are relatively unique because: our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and. Property Tax Calculator Brevard County Florida.

From exozqovjc.blob.core.windows.net

How Are Property Taxes Calculated In Brevard County at Marie Curtis blog Property Tax Calculator Brevard County Florida This is equal to the median property tax paid. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. Taxes on each parcel of real property. Property Tax Calculator Brevard County Florida.

From calculatoradam.com

Property Tax Calculator by Zip Code [2024] Calculator Adam Property Tax Calculator Brevard County Florida Adjust to suit your needs. florida property taxes are relatively unique because: our team is prepared to assist you with any questions you may have about property taxes, motorist services, vehicle and vessel registrations,. our brevard county property tax calculator can estimate your property taxes based on similar properties, and show you how your. real property. Property Tax Calculator Brevard County Florida.